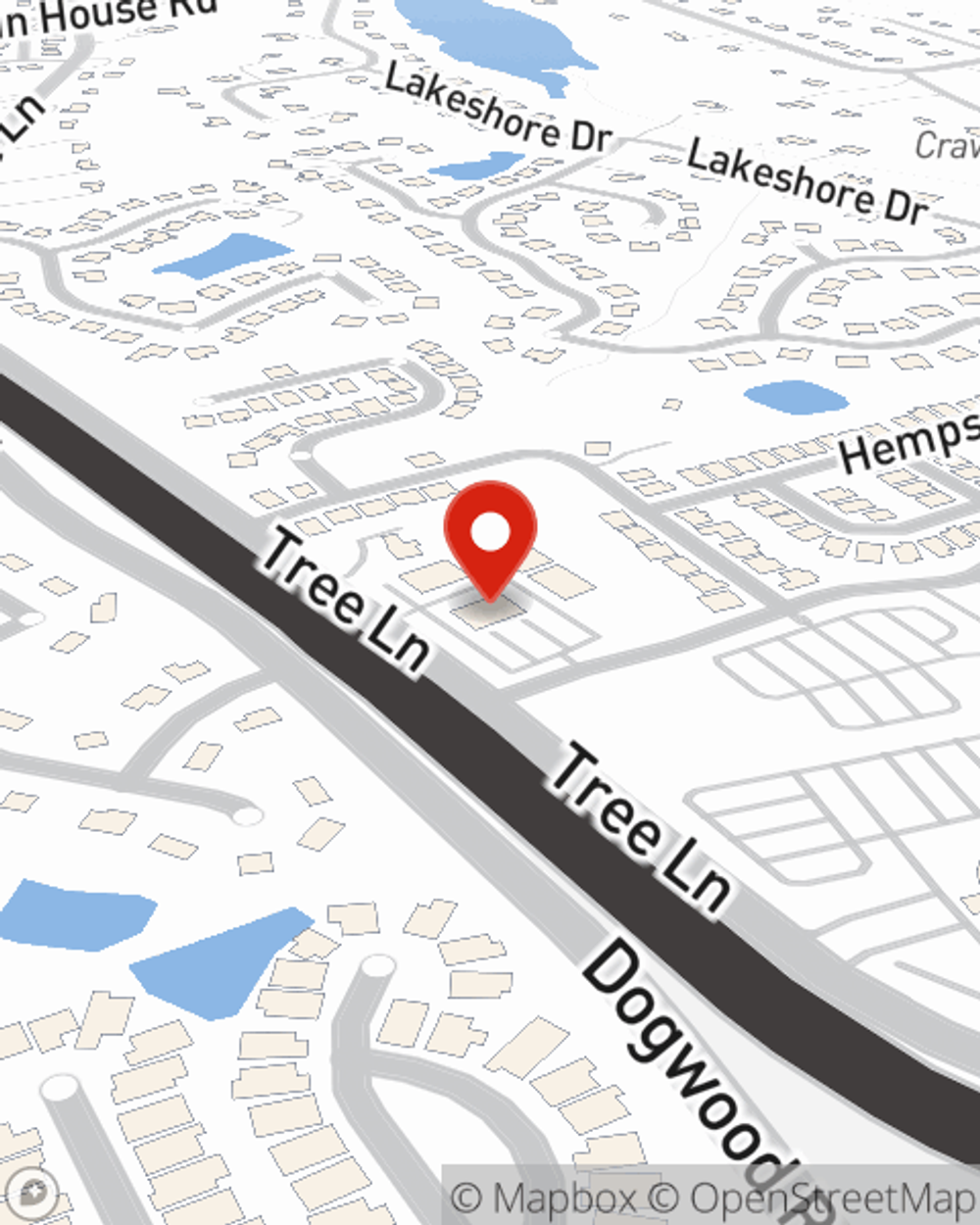

Renters Insurance in and around Snellville

Get renters insurance in Snellville

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Snellville

- Grayson

- Loganville

- Monroe

- Lilburn

- Lawrenceville

- Buford

- Norcross

- Duluth

- Braselton

- Dacula

- Auburn

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is beneficial, especially if you own items that would be difficult to fix or replace.

Get renters insurance in Snellville

Your belongings say p-lease and thank you to renters insurance

Agent Sean Johnsen, At Your Service

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a apartment or property, you still own plenty of property and personal items—such as a couch, guitar, tool set, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why choose renters insurance from Sean Johnsen? You need an agent who is passionate about helping you examine your needs and choose the right policy. With efficiency and personal attention, Sean Johnsen is here to help you insure your precious valuables.

Don’t let worries about protecting your personal belongings keep you up at night! Visit State Farm Agent Sean Johnsen today, and see how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Sean at (678) 436-8803 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Sean Johnsen

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.